Scholarships

Arizona’s Tuition Tax Credit Changes Lives!

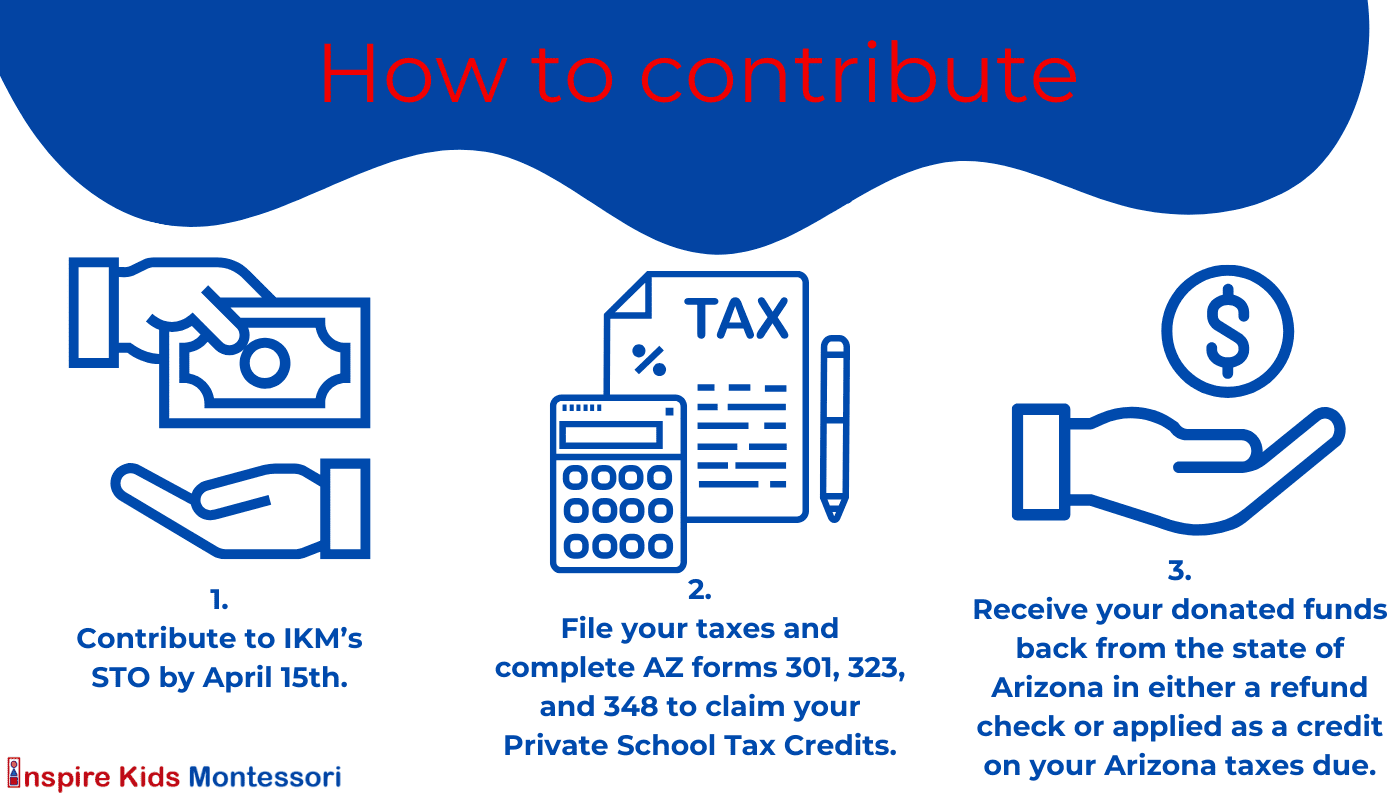

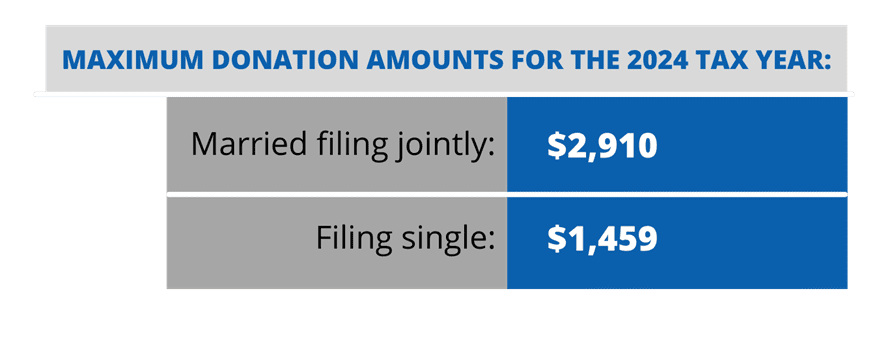

The private tuition tax credit allows individuals and participating corporations to redirect all, or a portion, of their Arizona state tax obligation to Inspire Kids Montessori STO. These funds qualify you, the donor, for a dollar-for-dollar tax credit from the state of Arizona. Every dollar you donate, up to the maximum allowed by the state, will be returned to you either a refund or a full credit of the amount towards what you owe in state taxes.These donated funds are critical tuition aid for students participating in the kindergarten program and who have completed their application for scholarship funds. Your thoughtful gift can make an impactful difference in the life of a child, please donate today!

“Children are the world’s most valuable resource and its best hope for the future.” – John F. Kennedy